[ad_1]

In a stunning turn of events that even the writers of satire would struggle to concoct, consumer spending has somehow clung to life in September like a raccoon dumpster diving for its last meal, according to the Commerce Department’s latest report, released Thursday for added suspense.

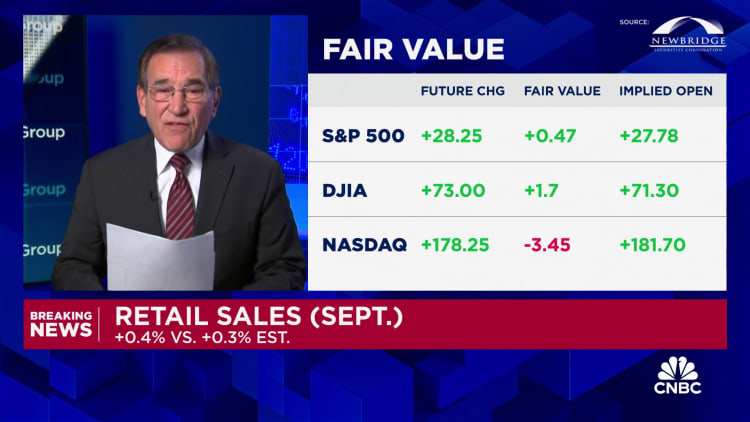

Yes, retail sales have reportedly skyrocketed by a jaw-dropping 0.4%, which is approximately one coffee break’s worth of gain. This improvement comes on the heels of August’s timid performance, where the numbers, if you squint hard enough, rose to an uninspiring 0.1%. Analysts had forecasted a lukewarm 0.3% rise, so I guess it’s safe to say we beat expectations! Hooray for us!

Now, if we exclude autos, which are as essential as they are forgettable in retail discussions, things further accelerated to a whopping 0.5%. But alas, clarity is for suckers since this data is beautifully adjusted for seasonal factors but not inflation—which was cheekily recorded at 0.2% this month. So don’t worry folks; those prices are just an optical illusion!

Diving deeper into the cosmic whirlpool of economic news, the Labor Department shared that initial unemployment claims fell to 241,000, a delightful decline of 19,000! Who knew a few hurricanes could wash away so many jobless claims? Florida and North Carolina reportedly celebrated by throwing a hurricane-themed barbecue, complete with “Tropical Storm Tango” as the flavor of the week.

If we glance over at Wall Street—it’s up, naturally! Because nothing screams “economic resilience” like investors eagerly betting their money while making increasingly questionable decisions. Yet, Treasury yields also decided to get in on the upward action, like that one friend who insists on double-dipping at the chip bowl.

On the retail battlefield, it appears miscellaneous store retailers have suddenly become the life of the party, reporting a 4% expansion. Meanwhile, clothing stores grew by 1.5% and the local bars and restaurants also graced us with a 1% boost, which surely compensates for the gas stations’ 1.6% plummet—in a what’s-good-for-the-gander scenario. Because who wants to spend money on actual gas when they could grab a drink instead?

The silver lining? Sales did climb 1.7% compared to last year, but let’s not forget that pesky inflation rate of 2.4%. It’s like buying a pair of shoes on an installment plan—those payments just keep coming.

Just when you thought you understood the financial universe, the Fed decided to cut its benchmark borrowing rate by half a percentage point, a move dressed in confidence over inflation’s slow decline. However, whispers of a softening labor market linger just like last week’s fish. Plentiful yet faintly ominous.

Meanwhile, across the pond, the European Central Bank rode the inflation rollercoaster with a quarter-point rate cut and reassuring grins of confidence. Their economic narrative is sponsored by the phrase “confidently cautious,” which should definitely be a tagline for our times.

As a parting gift, the Philadelphia Fed revealed its manufacturing index leapt to 10.3, a figure that suggests we might just be expanding—if only we could mitigate our widespread existential angst! Hooray for progress, even if it feels more like moving sideways in a hamster wheel.

Source